Journey to Change

Explore Scotland's stories on our blog and get inspired to host your next business event in a destination that fights against climate change, values thriving communities, embraces innovation and has sustainable development as a priority. Start your journey to change in Scotland.

Journey to Change

© VisitScotland

Platform for Global Solutions

Scotland stands at the forefront of innovation, technology, and sustainable development, making it a dynamic and knowledgeable destination for business events. Our stages are platforms for the driving force of change, where leaders share, audiences engage, and we all debate.

Five minutes with CENSIS, a VisitScotland Transformation Protocol Partner

A hub for innovation, technology and sustainability, Scotland is a progressive and knowledgeable destination for business events in these sectors.

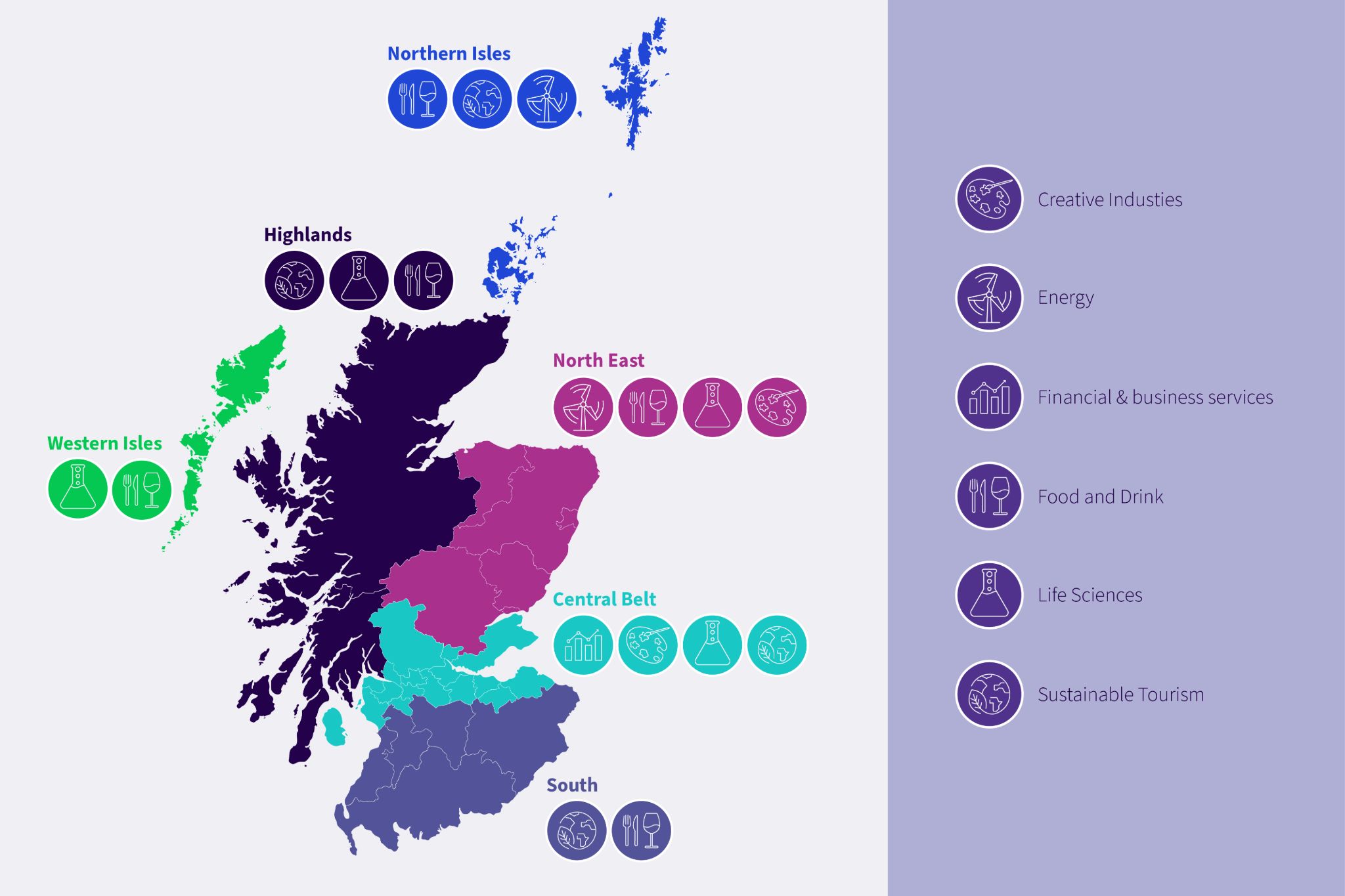

Scotland’s Dynamic Sectors

Scotland is an innovative and dynamic country, making it an ideal destination for association conferences and high-profile corporate meetings.

Dundee strives to become UK’s leading electric vehicle city

Scotland’s fourth largest city, Dundee, is spearheading technological innovation that is accessible to all.

In conversation with StrathAIS

StrathAIS offers a platform for students to grow as engineers and leaders and help to form the foundations for industry progress within Scotland.

Building Scotland's green hydrogen sector

We look at the country's pioneering projects and the exciting developments taking place which will support Scotland in achieving its net zero goals.

Geography - The Subject of our Age

Uncover the power of geography in addressing global challenges and inspiring positive change with the Royal Scottish Geographical Society.

Transitioning Energy

Established in April 2021, ETZ Ltd is a private sector-led and not-for-profit company spearheading North East Scotland's energy transition ambition.

Scotland's Home for Innovation

Explore Dundee's Michelin Scotland Innovation Parc (MSIP) – a hub for green tech and sustainability, driving Scotland's journey to net zero.

The James Hutton Institute

We spoke with Colin Campbell, CEO at The James Hutton Institute, about the transformative work being conducted by the group.

Life Sciences Innovation

Opening in 2028 at St. Mary's Hospital in north-west London, The Fleming Centre will stand at the forefront of the battle against AMR.

Changing Tomorrow by Meeting Today

Discover the impact of business events and community connections across Scotland. Our events create meaningful change by bringing people together to share ideas, foster connections, contribute to society, and build a brighter tomorrow.

Connecting People with Nature: Rewilding the Scottish Highlands

The Dundreggan Rewilding Centre by Trees for Life aims to rewild the Scottish Highlands. We discover how event organisers can support its mission.

Boosting incentive travel with local connection

SITE Scotland and Cyrenians create opportunities for incentive groups to host impactful events that benefit the local community.

Making a difference in Scotland’s communities

Learn how organisations bringing their events to Scotland can support Cyrenians.

International Delegates Day

Celebrating International Delegate's Day (25 April) as a reminder that meetings can facilitate transformational change.

The Green Team

Edinburgh-based charity, The Green Team, provides transformational experiences that connect children and young people to nature.

Empowering people through food and community

We spoke with Angela Moohan, Founder and CEO, The Larder, about her experiences and the impact of the organisation.

Human and Ecological Wellbeing

Create events that nurture both people and the planet. Our meeting places are cathedrals of knowledge, the pillars on which we can build ideas for putting human and ecological wellbeing first.

Sustainable Gastronomy Day

Scottish venues share why integrating local food stories into meetings and events enhances the experience and gives back to the local economy.

How business events are powering the Net Zero journey

World Environment Day: Scotland stands tall as a global example of how business events can play a transformative role in tackling the climate crisis.

Five minutes with WanderWomen

WanderWomen Scotland offers award-winning outdoor experiences that blend mindfulness and adventure for women and mixed corporate teams.

Reducing emissions at Cairngorms National Park

We spoke with Grant Moir, CEO of the Cairngorms National Park Authority to discuss the National Park's peatland programme.

Five minutes with Mercat Tours

We spoke with Kat Brogan at Mercat Tours to discuss the work of the organisation and the importance of engaging with underprivileged communities.

In conversation with Edinburgh Airport

We spoke with Gordon Robertson at Edinburgh Airport about their efforts to green their operations.

Scotland's International Environment Centre

The establishment of Scotland's International Environment Centre (SIEC) marks a pivotal moment in our journey towards a sustainable future.

World Mental Health Day

We spoke with Chris McCoy Lavery MBE on how VisitScotland is helping employees manage and further understand the complexities of mental health.